MarketWatch guide explains djia, dow jones, nasdaq, s&p 500 today, futures, and opening times in plain English—plus FAQs and practical tips.

Why “Today’s Market” Feels So Fast

If you’ve ever searched s&p 500 today and felt like the numbers changed the second you blinked—yep, that’s normal. Modern markets move quickly because information travels instantly. A single earnings report, a central bank comment, or a global headline can push prices up or down in minutes.

Here’s the big idea: indexes (like dow, nasdaq, and s&p 500) don’t move because of magic. They move because people are constantly buying and selling the stocks inside them. When demand rises, prices tend to rise. When fear kicks in, prices often drop.

A helpful mindset is to treat daily moves like weather. Some days are sunny (steady gains). Some days are stormy (sharp drops). But your long-term plan shouldn’t change every time the wind blows.

Meet the Big Three Indexes: dow, nasdaq, and the s&p 500

Most “market talk” in the U.S. boils down to three major indexes:

- dow jones (often called “the Dow”)

- nasdaq (often referring to the Nasdaq Composite)

- s&p 500 (a broad measure of large U.S. companies)

They’re like three different camera angles on the same football game. One angle focuses on a small group of stars, another highlights a tech-heavy crowd, and the third tries to show the whole field.

dow jones industrial average vs broad indexes

The dow jones industrial average is a famous index made up of 30 large U.S. companies, and it’s price-weighted—meaning higher-priced stocks can sway it more than lower-priced ones. S&P Global

That’s different from indexes like the S&P 500, which are generally discussed as broad measures of market performance.

nasdaq composite and tech influence

The nasdaq composite includes thousands of stocks listed on Nasdaq and is known for heavier exposure to technology. Because tech stocks can swing more sharply, the Nasdaq often feels more “zoomy” on up days and more painful on down days. FRED+1

djia: What It Is and Why People Still Watch It

Even if you don’t invest directly in it, djia shows up everywhere—TV tickers, news alerts, and daily recaps. The Dow remains popular partly because it’s old, widely recognized, and easy to quote in headlines.

What it’s good for:

- A quick “pulse check” of big, well-known companies

- A headline-friendly summary of market mood

What it’s not perfect for:

- Measuring the entire market (it’s only 30 companies)

- Giving equal “fair weight” to companies (it’s price-weighted) S&P Global

So when you see djia today moving a lot, remember: it can be influenced by a few high-priced stocks more than you might expect.

The s&p 500 index: America’s “Report Card”

The s&p 500 index is widely seen as a strong single gauge of large U.S. companies. It includes 500 leading firms and represents a large share of the market’s available capitalization. S&P Global

Why people like it:

- It’s broad (covers many sectors)

- It’s commonly used as a benchmark for “the market”

- It helps investors compare performance more fairly than a small index can

When people say “the market was up today,” they often mean the s&p 500 was up—even if not everyone says it out loud.

sp 500, sp500, and “s&p 500 today”: Same Idea, Different Labels

Let’s clear up a common confusion fast:

- sp 500 and sp500 are informal ways people type the S&P 500.

- sp 500 usually means the same thing as s&p 500 in everyday conversation.

- s&p 500 today is a search phrase people use when they want the latest move, news, and context.

They’re basically different nicknames pointing to the same “big scoreboard.”

Futures 101: s&p 500 futures and What They Signal

s&p 500 futures are contracts that trade for many hours outside the normal stock session. People watch them because they can hint at market sentiment before the opening bell.

But here’s the honest truth: futures are a clue, not a guarantee.

Why futures can be useful:

- They reflect overnight reactions to global news

- They help traders plan risk before the open

Why futures can mislead:

- Overnight trading can be thinner (moves may be exaggerated)

- Sentiment can flip quickly once regular trading starts

On CME Globex, equity index futures trade during a long window across the week, with scheduled breaks. CME Group+1

Overnight trading and the “gap” at the open

Ever noticed prices “jump” at the open? That’s the gap. Overnight news gets priced into futures and pre-market trading, and then regular trading opens with everyone reacting at once.

what time does the stock market open? (And Close)

If you’ve typed what time does the stock market open, the standard answer for U.S. exchanges is:

- 9:30 a.m. to 4:00 p.m. Eastern Time for the core session New York Stock Exchange+1

That’s the regular trading day most people mean when they say “the market is open.”

Pre-market and after-hours risks

Extended hours exist, but they can be trickier:

- Fewer buyers/sellers

- Wider bid-ask spreads

- Higher chance of whipsaw moves Kiplinger+1

If you’re new, it’s usually smarter to focus on the core session first—simple beats stressful.

How to Read “Today” Keywords Without Getting Fooled

Search terms like these are super common:

- dow today

- dow jones today

- nasdaq today

- s&p 500 today

- djia today

They’re all trying to answer one question: “What’s happening right now?”

A better way to interpret them is to look for three layers:

- Price move (up/down, how much)

- Reason (earnings, rates, inflation, geopolitics, sector news)

- Breadth (is it just a few stocks, or many?)

When only a handful of large names move, headlines can sound dramatic even if the rest of the market is calm.

ETFs in Plain English: spy stock and Index Tracking

You might see spy stock in searches because SPY is a massively popular ETF designed to track the S&P 500’s performance (before fees/expenses). SSGA

Think of an index like a scoreboard—and an ETF like SPY as a product that tries to follow that scoreboard closely.

Why people use index ETFs:

- Easy diversification in one purchase

- Clear benchmarks

- Lower complexity than picking dozens of individual stocks

Tools & Tabs People Use (Charts, Quotes, Watchlists)

Many investors use a simple routine each day:

- Check the big indexes: dow jones, nasdaq, s&p 500

- Scan sector performance (tech, energy, healthcare, etc.)

- Look at futures and rates if you want extra context

- Review a short news summary for major catalysts

Some people also use sites like MarketWatch for market news, quotes, and broad market snapshots. MarketWatch+1

News aggregation and headlines

Headline rule of thumb:

If a story makes you feel panicked, pause and verify. Look for:

- Primary source details (earnings release, official statement)

- Multiple reputable outlets reporting the same facts

- Whether the move is market-wide or just a few tickers

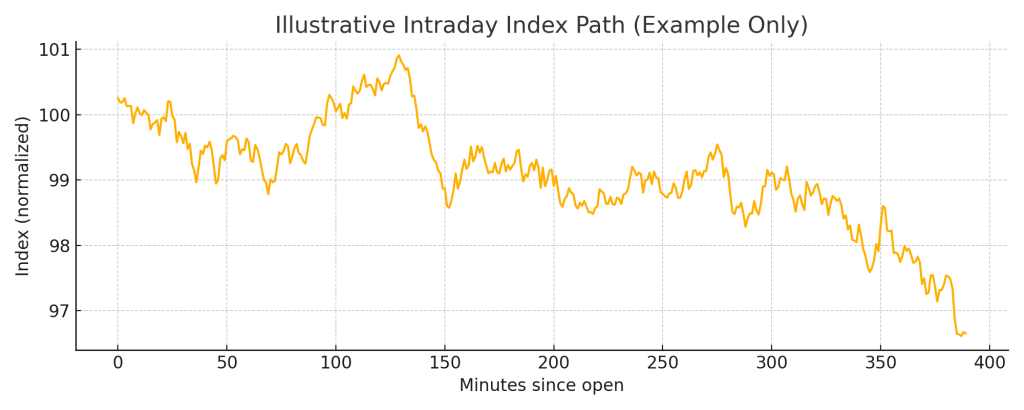

The “kick” effect: sudden moves and momentum

Sometimes the market seems to “kick” suddenly—like a sharp spike or drop that comes out of nowhere. That can happen due to:

- A breaking headline

- A big institutional order

- A key chart level breaking (momentum traders pile in)

Your best defense is a calm plan: position sizing, diversification, and not making decisions in a rush.

Common Mistakes New Investors Make

Here are the big ones (and how to dodge them):

- Chasing “today” moves

- Fix: Focus on a process, not a headline.

- Overreacting to one index

- Fix: Check the s&p 500 plus the nasdaq composite and the dow for balance.

- Confusing futures with certainty

- Fix: Treat s&p 500 futures as a signal—not a promise. CME Group+1

- Ignoring trading hours and liquidity

- Fix: Know the core session and be cautious in extended hours. New York Stock Exchange+1

Keyword Quick-Reference (So Everything Stays Clear)

| Keyword | Plain-English Meaning |

|---|---|

| djia | The Dow Jones Industrial Average in shorthand |

| dow jones | Common name used for the Dow |

| nasdaq | Often refers to the Nasdaq Composite in everyday talk |

| s&p 500 today | A search phrase for the latest S&P 500 move and news |

| djia today | A search phrase for the latest Dow move and news |

| sp 500 | Informal way people type S&P 500 |

| s&p 500 | The S&P 500 index name |

| sp500 | Another informal way people type S&P 500 |

| nasdaq today | A search phrase for the latest Nasdaq move and news |

| dow | Short nickname for Dow |

| nasdaq composite | Index covering thousands of Nasdaq-listed stocks FRED+1 |

| dow jones industrial average | Formal name of the Dow S&P Global |

| kick | Sudden burst move or momentum pop |

| spy stock | Search phrase often meaning SPY (S&P 500 tracking ETF) SSGA |

| dow today | A search phrase for live Dow context |

| s&p 500 index | Refers to the S&P 500 as an index S&P Global |

| what time does the stock market open | Popular question about regular market hours New York Stock Exchange+1 |

| s&p 500 futures | Futures contracts tied to S&P 500 performance CME Group+1 |

FAQ

1) what time does the stock market open in the U.S.?

The core session for NYSE and Nasdaq is 9:30 a.m. to 4:00 p.m. Eastern Time. New York Stock Exchange+1

2) What’s the difference between dow jones and s&p 500?

dow jones tracks 30 large companies and is price-weighted, while s&p 500 includes 500 leading companies and is widely used as a broad large-cap gauge. S&P Global+1

3) Why does nasdaq today sometimes move more than the Dow?

The nasdaq composite is more tech-heavy, and tech stocks can be more volatile—so swings can look bigger. FRED+1

4) Are s&p 500 futures a reliable predictor of the open?

They can hint at sentiment, but they’re not a guarantee. Overnight liquidity and breaking news can change the direction quickly. CME Group+1

5) What is spy stock and why do people watch it?

SPY is an ETF that aims to track the S&P 500’s performance (before fees/expenses). Many people watch it as a tradable “proxy” for the index. SSGA

6) Where can I check quick market headlines and quotes?

Many investors use financial news hubs and quote pages; for example, MarketWatch provides market news and market data dashboards. MarketWatch+1

Conclusion

Following the market doesn’t have to feel like drinking from a firehose. If you keep your routine simple—check the dow, nasdaq, and s&p 500, understand what futures are (and what they aren’t), and learn the basic trading hours—you’ll be miles ahead of the average headline-chaser.

The goal isn’t to predict every wiggle. It’s to build a steady system that helps you stay calm, informed, and consistent—whether markets are smooth or whether they “kick” into chaos for a day.